Accountant Digital Marketing

Marketing Tips for Accountants

We keep updated on the latest marketing trends for accountants. This includes search ads, social media, email marketing, lead generation, CRO, and more!

Digital Marketing Services

Digital Marketing Tactics for Accounting Firms

Digital marketing for accounting firms involves advertising online using websites, search results, social channels, email campaigns, or even mobile apps.

Most accountants think of internet marketing as another phrase for search engine optimization or paid advertising. While both of those services are used in online advertising, neither fully explain the depth of a modern website advertising program for accountants.

Today's digital marketing campaigns often include dozens of tactics, all working in tandem to help your accounting firm improve visibility and conversions.

Let's discuss what our internet marketers have found to work best for those in this industry!

50+ Internet Advertising Strategies for Accountants

We're a team of online advertising consultants with deep knowledge of website advertising needs for accounting firms.

Over the years, we've worked with a wide variety of accountants to help improve their digital marketing. The tactics discussed in this section can help with digital marketing for accountants and even:

- Financial Consultancies

- Tax Agencies

- Audit Companies

- Bookkeeping Services

- CPA Firms

- Forensic Accounting Firms

- Government Accounting Offices

- Non-profit Accounting Organizations

- Business Management Firms

- Risk Management Consultancies

- ...and more!

A Few of Our Digital Marketing Experts

1.) Lead Generation for Accounting Companies

Lead generation is a digital marketing strategy that can greatly benefit your accounting company. It focuses on attracting potential clients and capturing their contact information to nurture them into paying customers. By implementing targeted lead generation tactics, you can effectively grow your client base and increase revenue. Here are 5-10 specific strategies tailored to your accounting business:

- Industry-Specific Content Marketing: Create informative blog posts, articles, or e-books that address accounting challenges faced by specific industries. For example, provide tax tips for small businesses or guidance on financial planning for healthcare professionals. By offering valuable insights tailored to their needs, you can attract leads from these industries who are seeking expert accounting services.

- Webinars on Tax Planning: Host webinars focused on tax planning strategies for individuals or businesses. Share insights on tax deductions, credits, and compliance tips. Collect attendee information during registration to generate leads interested in tax-related services. This strategy positions your accounting company as a trusted resource and generates leads seeking assistance with their tax planning needs.

- Partnerships with Business Consultants: Collaborate with business consultants, such as management or HR consultants, to offer bundled services. For example, jointly promote a package that combines accounting services with business process optimization. By targeting businesses looking for comprehensive solutions, you can generate leads seeking a holistic approach to their financial needs.

- Referral Program for Existing Clients: Implement a referral program that rewards existing clients for referring new clients. Offer incentives such as discounts on future services or gift cards. Encourage your satisfied clients to recommend your accounting services to their professional network. This strategy turns your clients into brand ambassadors and generates high-quality leads from their referrals.

- Localized SEO for Accounting Services: Optimize your website and online presence for local search by incorporating location-specific keywords. Focus on search terms like "accounting services in [city name]" or "CPA in [neighborhood name]." This approach allows you to attract leads specifically looking for accounting services in your area, increasing the chances of conversion.

- Social Media Advertising for Startups: Run targeted social media advertising campaigns aimed at startups and entrepreneurs. Highlight your expertise in helping new businesses navigate accounting and financial challenges. Emphasize services like business formation, tax planning, and financial forecasting. By reaching out to this specific audience, you can generate leads from startups seeking accounting support.

- Free Financial Health Checkup: Offer a free financial health checkup to prospective clients. Assess their current financial situation, identify areas for improvement, and provide recommendations for financial growth and stability. This strategy allows you to showcase your expertise and build trust with potential clients who may eventually hire your accounting services.

- Collaboration with Nonprofit Organizations: Partner with local nonprofit organizations and offer accounting workshops or seminars. Educate nonprofit leaders on best practices for financial management, compliance, and reporting. During these sessions, collect contact information from attendees interested in additional accounting support. This strategy positions your company as a knowledgeable resource for the nonprofit sector and generates leads seeking specialized accounting services.

- LinkedIn Lead Generation: Utilize LinkedIn's advanced targeting features to reach professionals in specific industries or job roles. Create engaging content, such as industry-specific articles or downloadable resources, and promote them through LinkedIn ads. By delivering valuable content to your target audience, you can capture leads who are actively seeking accounting services.

- Web Presence Optimization: Ensure your website is optimized for lead generation by incorporating clear calls-to-action (CTAs) on relevant pages. Offer resources such as free guides, checklists, or templates that visitors can download in exchange for their contact information. This strategy allows you to capture leads who are interested in valuable resources and establishes you as a trusted authority in accounting.

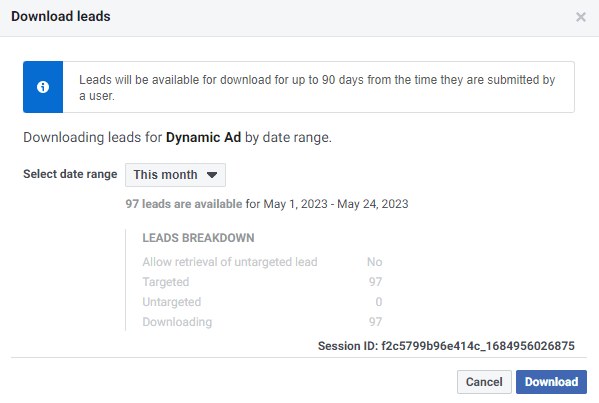

2.) Social Advertising for Accountants

Social advertising is a powerful digital marketing strategy that can benefit your accounting business or organization. By utilizing social media platforms to promote your services and engage with potential clients, you can enhance your online presence and attract a targeted audience. Here are five specific examples of how social advertising can help your accounting business:

- Promoting Tax Season Services: With social advertising, you can create targeted ad campaigns during tax season to reach individuals or businesses seeking tax-related services. By focusing on relevant keywords, demographics, and interests, you can ensure your ads are seen by those who are more likely to require accounting assistance during this critical period.

- Showcasing Expertise with Educational Content: Use social advertising to share informative content such as blog posts, infographics, or video tutorials that highlight your expertise as an accountant. By providing valuable insights on financial matters, you establish trust with your audience, positioning yourself as a reliable source for financial advice and services.

- Targeting Startups and Entrepreneurs: Social media platforms offer advanced targeting options, enabling you to focus your ads on startup owners and entrepreneurs. You can tailor your messaging to address their specific accounting needs, such as business planning, bookkeeping, and tax compliance, making your services more appealing to this niche market.

- Remarketing to Website Visitors: Implementing social media remarketing allows you to reconnect with individuals who have previously visited your website. By displaying relevant ads to these potential clients while they browse social media, you reinforce your brand and increase the likelihood of converting them into actual customers.

- Running Referral Incentive Campaigns: Encourage your satisfied clients to refer their friends, family, or colleagues to your accounting services through social advertising. Offer incentives like discounts or free consultations to both the referrer and the referred, boosting word-of-mouth marketing and expanding your client base.

3.) Conversion Rate Optimization (CRO) for Accountanting Firms

Conversion rate optimization is a digital marketing strategy that focuses on maximizing the effectiveness of your website and paid advertising to increase the percentage of visitors who take desired actions, such as contacting you for accounting services or filling out a lead form. By implementing CRO techniques, you can improve your online presence and boost conversions for your accounting business. Here are 7 examples of how conversion rate optimization can help your business:

- Personalized Call-to-Action (CTA): Customize your CTAs based on the specific service or content your visitor is interested in. For example, if a visitor is browsing your tax preparation page, the CTA could be "Get a Free Tax Consultation." Personalized CTAs are more relevant and compelling, leading to higher conversion rates.

- Live Chat Support: Implement a live chat feature on your website to provide real-time assistance to visitors. A live chat can address any queries or concerns instantly, increasing trust and confidence in your services. Visitors are more likely to convert when they receive immediate help.

- Client Testimonials and Case Studies: Showcase success stories and positive experiences of your past clients through testimonials and case studies. Real-life examples of how your accounting services have benefited others can build trust and credibility, influencing potential clients to choose your firm over competitors.

- Exit-Intent Popups: Use exit-intent popups that appear when a visitor is about to leave your website. Offer an attractive incentive, such as a free financial planning guide or a discount on services, to encourage visitors to stay and take action before leaving. Exit-intent popups can recover potential lost conversions.

- Clear Contact Information: Ensure that your contact information, including phone number and email, is prominently displayed on your website. Make it easy for visitors to get in touch with you. A clear and accessible contact information section reduces friction in the conversion process.

- Lead Magnets: Offer valuable lead magnets, such as a downloadable tax checklist or a financial planning template, in exchange for visitors' email addresses. Once you have their contact information, you can nurture leads through email marketing and increase the chances of conversion over time.

- Optimize Landing Pages: Create dedicated landing pages for specific accounting services and optimize them for targeted keywords. A well-optimized landing page can improve search engine rankings and attract more relevant traffic, increasing the likelihood of conversions for specific services.

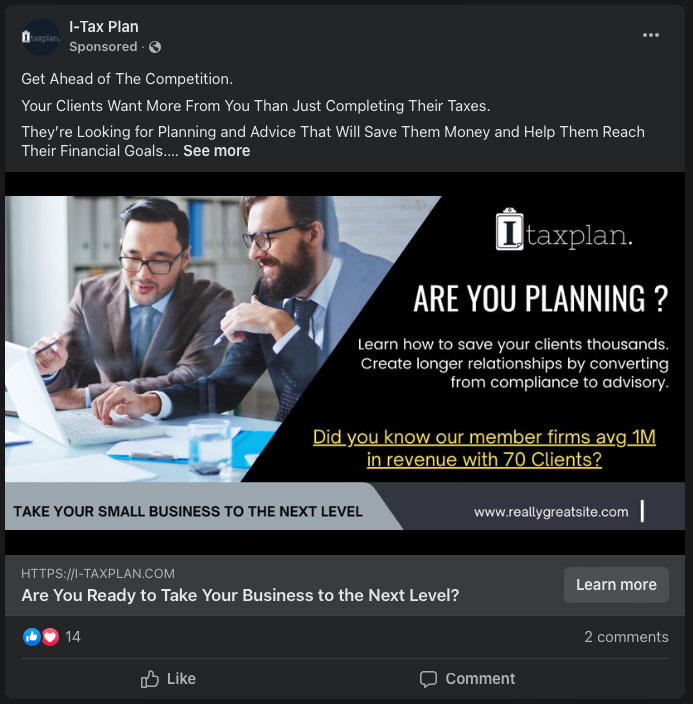

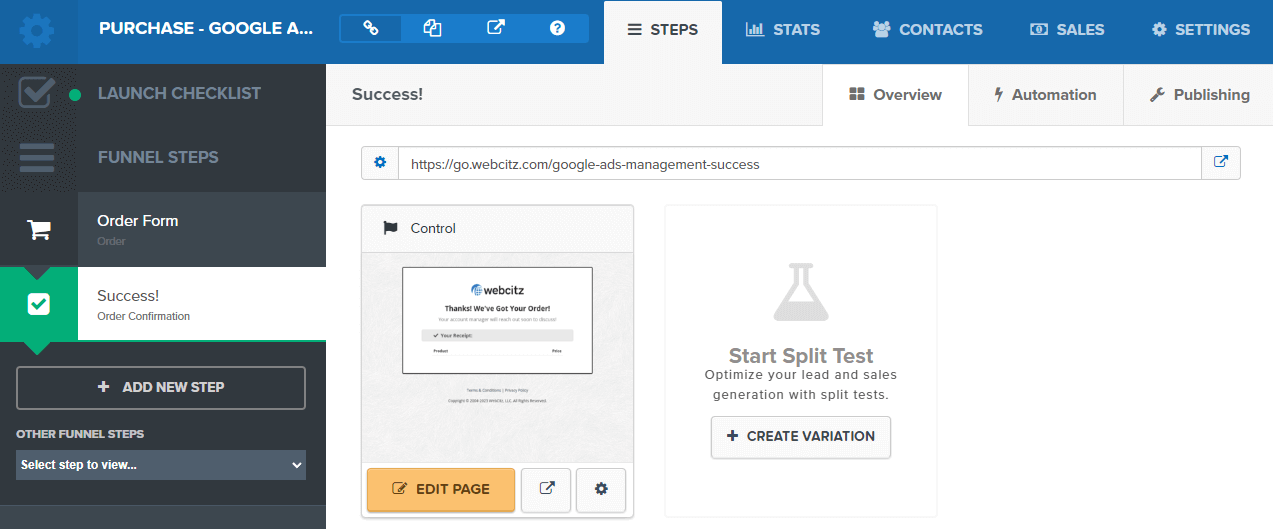

4.) Sales Funnels for Accountants

Sales funnels are a digital marketing strategy that guides potential clients through a structured process, from initial awareness to making a purchase decision. As an accountant, implementing sales funnels can help you attract leads, nurture them, and eventually convert them into paying clients. Here are 5 examples of how sales funnels can benefit your accounting business:

- Ebook Download Funnel: Create an ebook on a relevant accounting topic, such as "The Ultimate Guide to Tax Planning for Small Businesses." Offer this ebook as a free download in exchange for visitors' email addresses. Once they opt-in, you can nurture leads with follow-up emails, providing additional value and showcasing your expertise. Gradually, you can introduce your accounting services and encourage them to schedule a consultation, eventually leading to potential clients seeking your professional assistance.

- Webinar Registration Funnel: Host a live webinar on a specific accounting subject, like "Strategies for Maximizing Deductions in Your Tax Return." Promote the webinar through social media, email marketing, and your website. Encourage visitors to register for the webinar, and as they attend, you can present your accounting services as a solution to their financial needs. After the webinar, follow up with attendees, offering a limited-time discount for your services to prompt them to take action.

- Free Consultation Funnel: Offer a free 30-minute consultation to potential clients. Create a dedicated landing page that highlights the benefits of the consultation and the expertise you can provide. Interested prospects can fill out a form on the landing page to schedule the consultation. During the meeting, you can assess their accounting needs and demonstrate your value, increasing the likelihood of them choosing your services for their financial needs.

- Referral Program Funnel: Set up a referral program for your current clients. Encourage them to refer friends, family, or colleagues in need of accounting services. Offer incentives, such as a discount on their next service or a gift card, for successful referrals. The referral program can expand your client base and attract qualified leads who are already familiar with your reputation and services through word-of-mouth.

- Retargeting Funnel: Implement retargeting ads for website visitors who didn't take action initially, such as scheduling a consultation or downloading an ebook. Show them targeted ads on platforms they frequently use, reminding them of your accounting services and encouraging them to return to your website. Retargeting helps to keep your accounting firm top of mind, increasing the chances of conversions from those who were interested but didn't convert during their first visit.

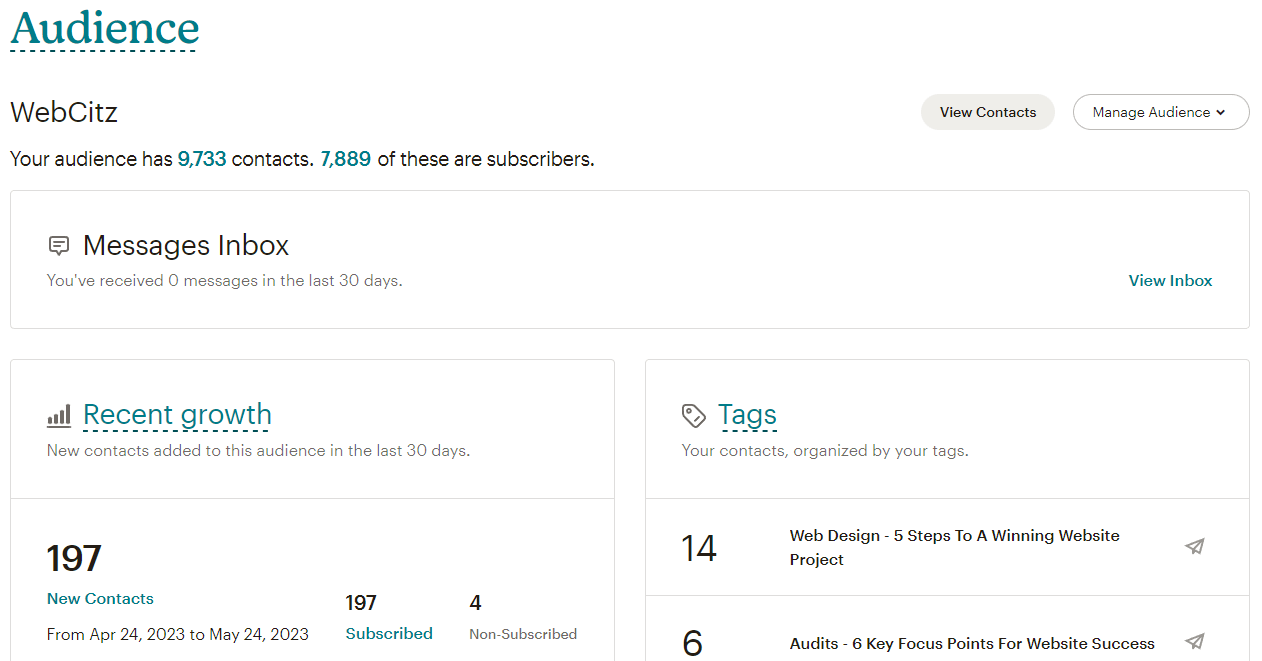

5.) Email Marketing for Accountants

Email marketing is a powerful digital marketing strategy that can significantly benefit your accounting business. It allows you to reach out to both current and potential clients directly through their inbox. Here are six examples of how email marketing can help your accounting business:

- Monthly Newsletters: Send out monthly newsletters to your client base to provide valuable insights on tax updates, financial tips, and accounting best practices. Newsletters help position you as a knowledgeable authority and keep your clients engaged with your services.

- Tax Season Reminders: Before the tax season begins, send personalized emails to your clients reminding them of important deadlines and documents required for filing. This proactive approach shows your clients that you care about their financial well-being and can help increase retention rates.

- Exclusive Offers and Discounts: Offer special discounts or exclusive deals on your accounting services through email campaigns. For example, provide a discount on tax preparation services during the early bird period. This can incentivize potential clients to take action and book your services.

- Referral Programs: Launch a referral program through email marketing, encouraging your current clients to refer their friends, family, or colleagues to your accounting services. Offer rewards, such as discounts or free consultations, to both the referrer and the new client. Referral programs can help expand your client base and generate more business.

- Personalized Financial Tips: Segment your email list based on client needs and send personalized financial tips and advice. For example, send tax-saving tips to business owners and retirement planning advice to individuals nearing retirement. Personalization shows that you understand your clients' unique situations and can help build trust.

- Thought Leadership Content: Share thought leadership content in your emails, such as whitepapers, ebooks, or blog posts, that address current accounting trends and challenges. Thoughtful and valuable content positions you as an expert in your field and can attract new clients seeking professional expertise.

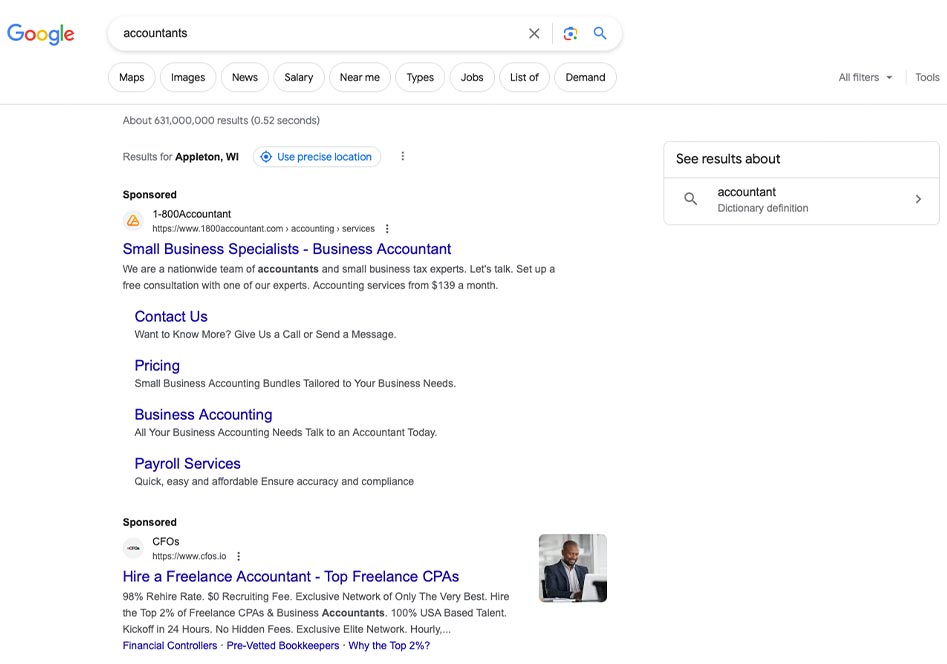

6.) Search Advertising for Accountants

Search advertising is a powerful digital marketing strategy for accountants that allows you to promote your services and reach potential clients when they are actively searching for accounting-related solutions online. By leveraging search engines like Google, you can display your ads to a targeted audience, increasing your visibility and driving relevant traffic to your website. Here are five examples of how search advertising can help your accounting business:

- Keyword-Targeted Campaigns: Set up keyword-targeted campaigns to appear in search results when users type in specific terms related to accounting services, such as "tax preparation," "bookkeeping," or "financial planning." This will ensure that your ads are shown to people actively seeking accounting solutions, increasing the likelihood of attracting potential clients.

- Local Targeting: Utilize location-based targeting to reach potential clients in your area. By focusing your ads on a specific geographic region, such as a city or a radius around your office, you can effectively connect with local businesses and individuals in need of accounting services, maximizing your impact within your community.

- Ad Extensions: Take advantage of ad extensions to provide additional information and make your ads more compelling. Use call extensions to include your phone number, making it easy for users to contact you directly. Employ sitelink extensions to direct users to specific pages on your website, such as your services, testimonials, or contact page.

- Remarketing: Implement remarketing campaigns to re-engage with users who have previously visited your website. By displaying targeted ads to these individuals as they browse the web, you can reinforce your brand and remind them of your accounting services, increasing the chances of conversion.

- Seasonal Promotions: Run time-limited campaigns during peak seasons, such as tax season or year-end financial planning. Tailor your ad messaging to address the specific needs and concerns of clients during these times, offering special promotions or discounts to encourage them to choose your accounting services.

7.) Content Marketing for Accounting Firms

Content marketing is an essential digital strategy that can significantly benefit your accounting firm. By creating valuable and relevant content, you can engage your target audience, establish your firm as a thought leader, and ultimately attract and retain more clients.

- Comprehensive Tax Guides: Produce in-depth tax guides tailored to specific client segments, such as small businesses, startups, or high-net-worth individuals. These guides should offer practical advice on navigating tax complexities and maximizing deductions, showcasing your expertise and understanding of their unique needs.

- Interactive Financial Tools: Develop interactive tools like budget calculators, retirement planning simulators, or investment ROI trackers. These tools can empower your website visitors to gain insights into their financial situations while positioning your firm as a valuable resource for their financial planning needs.

- Industry-Specific Content: Create targeted content that addresses financial challenges and opportunities within particular industries. For example, produce articles or videos discussing accounting best practices for healthcare providers, construction companies, or e-commerce businesses. This content demonstrates your firm's knowledge of their industry and positions you as a specialized service provider.

- Webinars on Regulatory Changes: Host webinars to educate your clients and prospects about recent tax law changes, accounting regulations, or financial reporting updates. These webinars showcase your commitment to keeping clients informed and offer opportunities to interact directly with your experts.

- Client Success Stories: Share compelling success stories of how your firm has helped clients achieve financial success or overcome specific challenges. Use case studies and testimonials to illustrate real-world results, build trust, and persuade potential clients to choose your services.

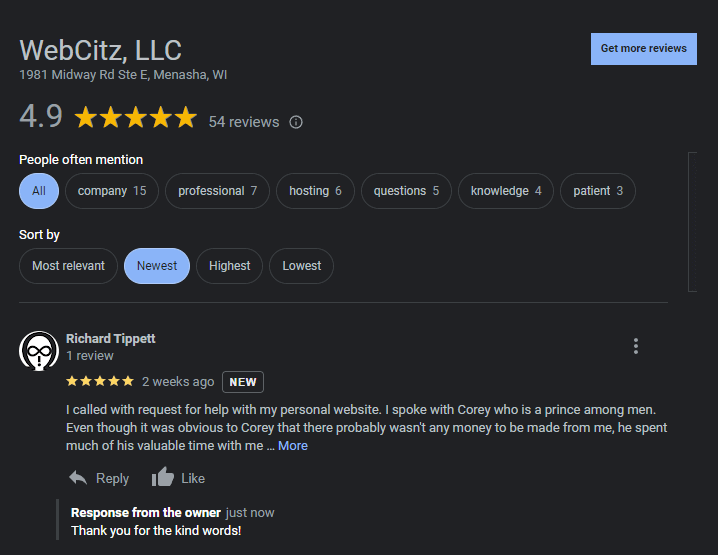

8.) Reputation Management for Accountants

Reputation management involves monitoring, addressing, and influencing your online reputation to ensure your accounting practice is perceived positively. Here are five examples of how reputation management can benefit your accounting business:

- Client Testimonials and Reviews: Collect and showcase positive client testimonials and reviews on your website and other online platforms. Reputation management ensures that potential clients can easily find and read about the positive experiences others have had with your accounting services, increasing their confidence in your firm.

- Responding to Feedback: Monitor online reviews and feedback about your accounting services regularly. Promptly respond to both positive and negative reviews in a professional manner. Addressing negative feedback with empathy and offering solutions demonstrates your commitment to client satisfaction and responsiveness.

- Building Authority and Thought Leadership: Publish informative and valuable content related to accounting, tax, and financial matters. Creating blog posts, whitepapers, and educational resources can position you and your firm as authoritative thought leaders in the industry, enhancing your reputation and credibility.

- Showcasing Accolades and Awards: Highlight any awards, certifications, or accolades your accounting firm has received. Reputation management involves strategically promoting these achievements on your website and social media platforms to build trust and differentiate your firm from competitors.

- Monitoring Online Mentions: Use reputation management tools to monitor mentions of your accounting firm across various online channels, including social media, review sites, and news articles. Staying aware of what others are saying about your firm allows you to address any potential issues or misinformation promptly.

9.) Video Marketing for Accountants

Video marketing is a dynamic strategy that involves creating and sharing engaging video content to attract, inform, and convert potential clients. As an accountant, you can tap into the potential of video marketing to showcase your expertise, build trust with your audience, and grow your business. Here are five tailored examples of how video marketing can be a valuable asset for your accounting firm:

- Client Testimonials: Encourage satisfied clients to share their success stories through video testimonials. Hearing about real-life experiences and positive outcomes from your accounting services can boost credibility and attract potential clients.

- Explainer Videos: Simplify complex accounting concepts and procedures by creating short explainer videos. Use visuals, animations, and concise language to help your audience understand tax regulations, financial planning, or accounting best practices.

- Live Webinars: Host live webinars on relevant accounting topics, such as tax-saving strategies or financial planning for small businesses. Interact with your audience in real-time, answer their questions, and establish yourself as a knowledgeable expert.

- Behind-the-Scenes Sneak Peeks: Offer glimpses of your accounting firm's daily operations or team culture through behind-the-scenes videos. This personal touch can humanize your brand and create a stronger connection with potential clients.

- Case Studies: Showcase successful financial projects or challenges your firm has tackled in the past through video case studies. Highlight the solutions you provided and the positive impact on your clients' financial situations.