Broker Digital Marketing

Marketing Tips for Brokers

We keep updated on the latest marketing trends for brokers. This includes search ads, social media, email marketing, lead generation, CRO, and more!

Digital Marketing Services

Online Advertising Services for Brokerage Firms

Digital marketing for brokerage firms involves advertising online using websites, search results, social channels, email campaigns, or even mobile apps.

Most brokers think of website advertising as another phrase for SEO or paid advertising. While both of those services are used in digital advertising, neither fully explain the depth of a modern internet advertising program for brokers.

Modern online marketing services include dozens of strategies, all working together to help boost visibility and conversions for your brokerage firm.

Let's talk about what our internet marketers have seen help people in this industry!

50+ Digital Marketing Tactics for Brokers

We're a team of internet marketing specialists with deep knowledge of online marketing needs for brokerage firms.

Over the years, we've worked with a wide variety of brokers to help improve their online advertising. The tactics discussed in this section can help with website marketing for brokers and even:

- Independent Mortgage Brokers

- Mortgage Lending Companies

- Mortgage Refinancing Companies

- Mortgage Loan Servicers

- Reverse Mortgage Lenders

- Jumbo Mortgage Lenders

- Commercial Mortgage Lenders

- Government-backed Mortgage Lenders

- Online Mortgage Lenders

- VA Loan Brokers

- FHA Loan Brokers

- ...and more!

A Few of Our Digital Marketing Experts

1.) Lead Generation for Mortgage Brokers

Lead generation is a vital digital marketing strategy for mortgage brokers to attract potential borrowers and generate quality leads for your mortgage services. By implementing targeted lead generation tactics, you can increase your client base and boost loan applications. Here are 5-10 specific strategies tailored to mortgage brokers:

- Content Marketing with Mortgage Guides: Create informative mortgage guides and articles on your website that educate potential borrowers about the mortgage process, types of loans, and tips for securing the best rates. By providing valuable information, you can attract leads who are in need of mortgage-related guidance and increase your chances of converting them into clients.

- Localized SEO Strategy: Implement a localized search engine optimization (SEO) strategy to target potential borrowers in specific areas. Optimize your website and content with location-specific keywords to rank higher in local search results. By appearing prominently in local searches, you can attract leads who are actively looking for mortgage brokers in their area.

- Offer Free Mortgage Consultations: Promote free mortgage consultations on your website or through targeted advertising campaigns. Allow potential borrowers to schedule a consultation to discuss their mortgage needs and receive personalized advice. By offering a free consultation, you can capture leads who are interested in your expertise and are more likely to proceed with your services.

- Partner with Real Estate Agents: Build relationships with local real estate agents and offer them incentives for referring clients to your mortgage services. Provide excellent service and quick turnaround times to earn their trust and increase the likelihood of receiving client referrals. By partnering with real estate agents, you can tap into their network and generate high-quality leads.

- Host Mortgage Webinars: Conduct webinars on mortgage-related topics such as first-time homebuying, refinancing options, or investment property financing. Promote these webinars through your website and social media channels. By delivering valuable insights and advice, you can establish yourself as an authority in the mortgage industry and attract leads who are interested in learning more.

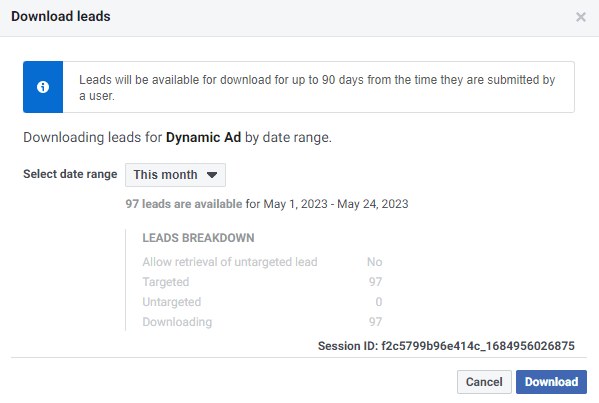

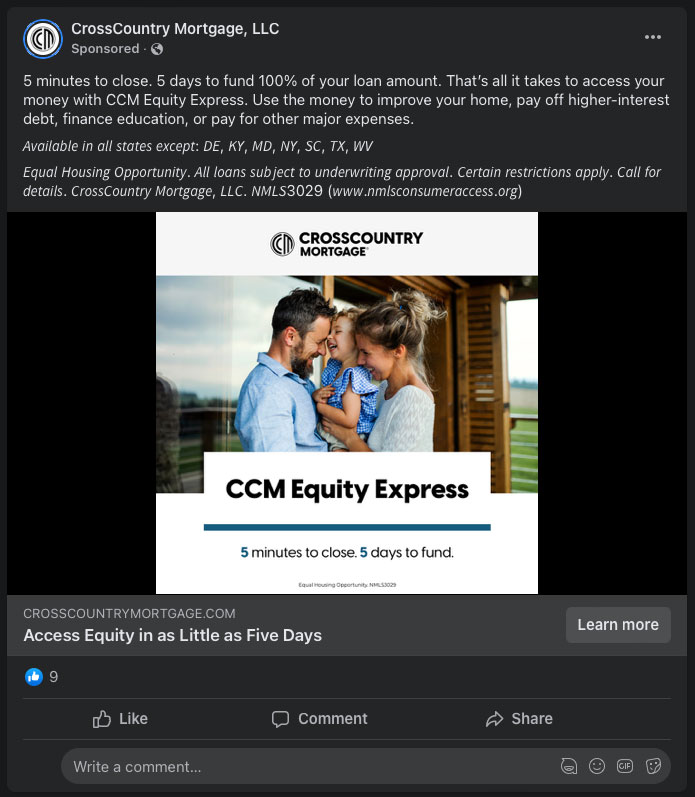

- Facebook Ads Targeting Homebuyers: Utilize Facebook ads to target potential homebuyers based on their demographics, interests, and behavior. Create engaging ad content that highlights your mortgage services, competitive rates, and personalized approach. By reaching the right audience on Facebook, you can capture leads who are actively considering homeownership and require mortgage financing.

- Online Mortgage Calculators: Add interactive mortgage calculators to your website that allow potential borrowers to estimate their monthly payments, affordability, or potential savings. By offering this useful tool, you can engage leads who are exploring their mortgage options and capture their contact information in exchange for the calculator results.

- Testimonials and Case Studies: Display testimonials and case studies from satisfied borrowers on your website and social media platforms. Highlight successful mortgage experiences and the benefits clients have gained from working with you. By showcasing real-life stories, you can build trust and credibility with potential borrowers and generate leads who are more likely to choose your mortgage services.

- Participate in Homebuyer Seminars: Collaborate with real estate agents, homebuilders, or local community organizations to host homebuyer seminars. Share your expertise on mortgage financing and answer questions from attendees. By providing valuable insights and advice, you can position yourself as a trusted resource and generate leads who are actively seeking mortgage solutions.

- Email Marketing with Exclusive Offers: Develop an email marketing campaign to nurture leads and stay top-of-mind. Offer exclusive mortgage-related content, tips, and special promotions to your email subscribers. By regularly engaging with potential borrowers through email, you can build relationships and increase the likelihood of converting them into clients.

2.) Social Advertising for Mortgage Brokers

As a mortgage broker, social advertising can be a powerful tool to attract potential homebuyers, expand your network, and generate leads for your mortgage services. Social media platforms offer advanced targeting capabilities, allowing you to reach individuals who are actively interested in buying a home or exploring mortgage options. Here are five examples of how social advertising can benefit your mortgage brokerage:

- First-Time Homebuyer Campaign: Create social media ads targeting first-time homebuyers. Highlight the benefits of working with a mortgage broker and the various mortgage options available for those entering the housing market. By providing valuable information and guidance, you position yourself as an essential resource for first-time buyers.

- Local Real Estate Market Insights: Utilize social advertising to share updates on the local real estate market and mortgage trends. Target audiences interested in buying a home in specific areas. By providing valuable market insights, you establish yourself as an expert in the local housing market, attracting potential homebuyers seeking the latest information.

- Refinancing Opportunities: Create social media ads promoting refinancing options for homeowners. Target individuals who may be interested in reducing their mortgage rates or consolidating debts. By showcasing the potential savings and benefits of refinancing, you can attract homeowners looking to optimize their mortgage arrangements.

- Retargeting for Abandoned Loan Applications: Implement retargeting ads on social media for users who started but did not complete a mortgage loan application on your website. Encourage them to resume the application process by highlighting the ease of applying through your brokerage and the personalized support you offer to secure the best mortgage terms.

- Homebuyer Webinars and Workshops: Utilize social advertising to promote webinars or workshops on homebuying and mortgage-related topics. Target individuals interested in homeownership and financial planning. By hosting educational events, you can showcase your expertise and build trust with potential clients, ultimately driving new leads for your mortgage services.

3.) Conversion Rate Optimization (CRO) for Mortgage Brokers

Conversion rate optimization is a vital digital marketing strategy that can significantly boost your mortgage broker business by improving website performance and enhancing the effectiveness of paid advertising. By optimizing your online presence, you can increase lead generation and conversions. Here are some examples of how CRO can benefit your mortgage broker organization:

- Clear and Concise Call-to-Action: Place clear and compelling CTAs on your website and in your paid ads. For instance, use CTAs like "Get Pre-Approved Now," "Compare Mortgage Rates," or "Speak to a Mortgage Expert." A straightforward CTA will prompt potential clients to take the desired action, leading to increased conversions.

- Mobile-Friendly Website: Ensure your website is fully optimized for mobile devices, as many potential clients may browse for mortgage options on their smartphones. A mobile-friendly website enhances the user experience and makes it easier for visitors to submit inquiries or contact you, increasing conversion rates.

- Chatbot Assistance: Implement a chatbot on your website to provide instant assistance to visitors. A chatbot can answer common questions, guide potential clients through the mortgage process, and offer personalized recommendations based on their needs. This proactive approach can lead to more conversions as it reduces the chances of visitors leaving without taking action.

- Customer Testimonials: Showcase positive testimonials from satisfied clients who have successfully obtained mortgages through your services. Testimonials can build trust and credibility, convincing potential clients that you are a reliable and trustworthy mortgage broker, leading to higher conversion rates.

- Live Webinars: Host live webinars or online events where you can educate potential clients about mortgage options, interest rates, and the home buying process. Webinars can position you as an industry expert and help build trust with attendees, potentially converting them into leads or clients.

- Transparent Pricing Information: Display clear and transparent pricing information on your website for various mortgage services. Potential clients appreciate upfront pricing details, which can reduce barriers and increase the likelihood of conversions.

- Personalized Recommendations: Use data from previous client interactions to offer personalized mortgage recommendations to website visitors. Providing tailored options based on their financial situation can enhance the user experience and improve the chances of conversion.

- Exit-Intent Popups: Implement exit-intent popups to capture the attention of visitors who are about to leave your website without taking action. Offer them a valuable resource, such as a mortgage rate comparison guide or a mortgage calculator, to entice them to stay and potentially convert.

- Highlight Benefits and Savings: Clearly communicate the benefits of working with your mortgage brokerage, such as faster approval processes, competitive interest rates, or cost savings. Highlighting these advantages can persuade potential clients to choose your services over competitors, leading to more conversions.

- Accelerate Response Time: Ensure you respond promptly to inquiries and leads received through your website or paid ads. Fast response times show potential clients that you value their interest and can lead to increased conversions.

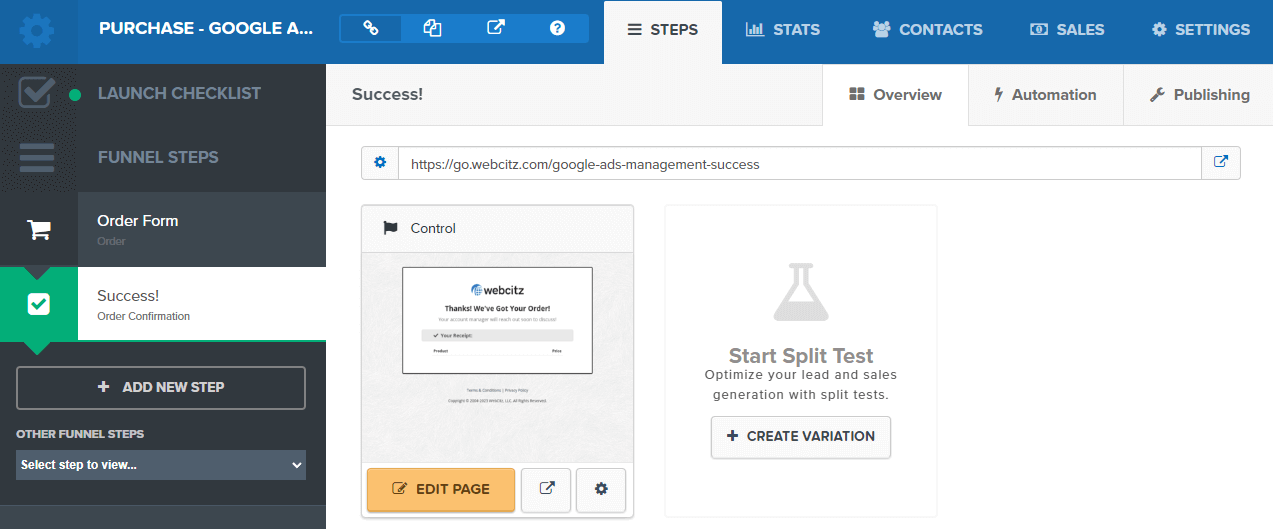

4.) Sales Funnels for Mortgage Brokers

As a mortgage broker, sales funnels can be a powerful digital marketing strategy to attract potential homebuyers, showcase your expertise in mortgage solutions, and convert leads into loyal clients. Sales funnels provide a systematic approach to guide potential clients through the home financing process and encourage them to choose your mortgage services. Here are 5 examples of how sales funnels can benefit your mortgage brokerage:

- First-Time Homebuyer Funnel: Create a landing page targeted at first-time homebuyers looking for mortgage solutions. Utilize social media advertising or partner with real estate agents to reach potential clients. The landing page should highlight your expertise in assisting first-time homebuyers and the mortgage options available to them. Offer a free consultation or a mortgage pre-approval service for first-time buyers. Follow up with email sequences that provide homebuyer tips, explain the mortgage application process, and encourage clients to schedule a consultation with your mortgage brokerage.

- Refinance Opportunity Funnel: Design a landing page targeted at homeowners seeking mortgage refinancing options. Utilize email marketing or collaborate with local financial advisors to attract potential clients. The landing page should emphasize your ability to find the best refinance deals tailored to homeowners' needs. Offer a complimentary mortgage analysis or a refinance rate check for interested homeowners. Follow up with email sequences that explain the benefits of mortgage refinancing, provide refinancing success stories, and encourage homeowners to explore their refinancing options with your mortgage brokerage.

- Investment Property Funnel: Create a landing page targeted at real estate investors in search of mortgage financing for investment properties. Utilize online advertising or partner with property management companies to reach potential clients. The landing page should showcase your experience in securing mortgages for investment properties and the financing options available. Offer a free investment property mortgage assessment or a rental property cash flow analysis for interested investors. Follow up with email sequences that provide insights on investment property financing, highlight successful investor case studies, and encourage real estate investors to inquire about mortgage solutions with your brokerage.

- Home Equity Loan Funnel: Design a landing page targeted at homeowners interested in accessing their home equity for financial needs. Utilize social media advertising or collaborate with home equity service providers to attract potential clients. The landing page should emphasize your ability to help homeowners tap into their home equity responsibly. Offer a complimentary home equity consultation or an equity release guide for interested homeowners. Follow up with email sequences that explain the advantages of home equity loans, provide examples of responsible uses of home equity, and encourage homeowners to explore their home equity options with your brokerage.

- VA Loan Funnel: Create a landing page targeted at military veterans and service members seeking VA loan options. Utilize email marketing or partner with veterans' organizations to reach potential clients. The landing page should highlight your expertise in assisting veterans with VA loans and the benefits of VA financing. Offer a free VA loan eligibility check or a specialized VA loan information packet for interested veterans. Follow up with email sequences that provide insights on VA loan benefits, showcase successful VA loan closings, and encourage veterans to discuss VA loan options with your mortgage brokerage.

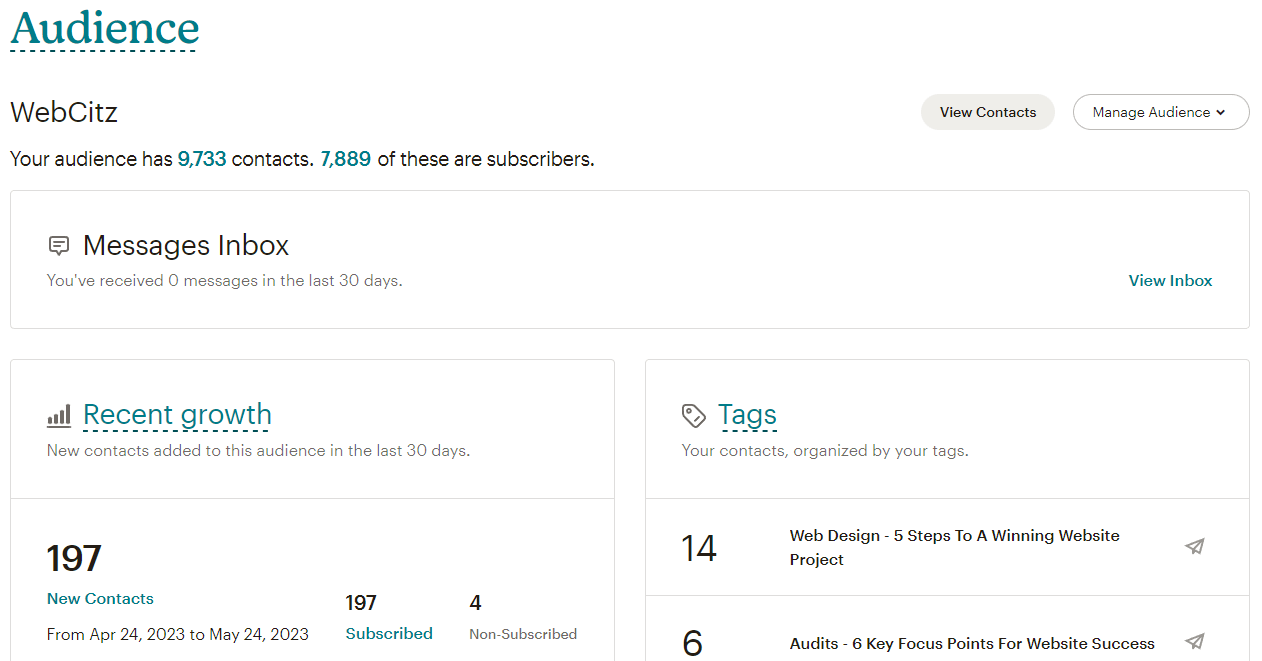

5.) Email Marketing for Mortgage Brokers

As a mortgage broker, email marketing can be a highly effective digital marketing strategy to nurture leads, build relationships, and stay top-of-mind with potential homebuyers. With email campaigns, you can showcase your expertise, provide valuable insights, and promote your mortgage services. Here are six examples of how email marketing can benefit your mortgage brokerage:

- Mortgage Rate Updates: Send regular emails to your subscribers with updates on mortgage rates and market trends. Providing valuable information on current interest rates can attract potential homebuyers and encourage them to reach out for more personalized mortgage advice.

- Personalized Loan Offers: Use email segmentation to send personalized loan offers to specific groups of subscribers based on their financial profiles and needs. Tailoring your offers to each recipient's situation can increase the chances of converting leads into clients.

- Homebuying Tips and Guides: Send educational emails that provide homebuying tips, guides, and resources to your subscribers. Offering valuable content can position you as a trusted advisor and establish your expertise in the mortgage industry.

- Refinancing Opportunities: Reach out to existing clients with emails about refinancing opportunities when market conditions are favorable. Highlighting potential cost-saving benefits can encourage repeat business and referrals.

- Client Success Stories: Share success stories and testimonials from satisfied clients who have secured mortgages through your services. These stories can build trust and credibility, encouraging potential homebuyers to choose your brokerage.

- Webinar Invitations: Host webinars on mortgage-related topics and send email invitations to your subscribers. Webinars provide a platform for you to showcase your knowledge and interact directly with potential clients, fostering a sense of community and engagement.

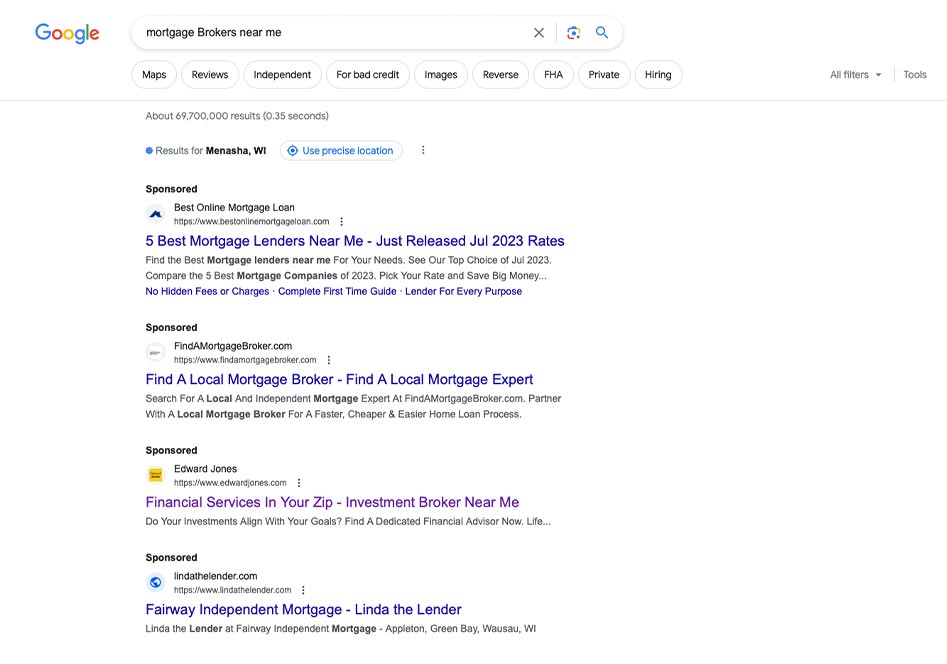

6.) Search Advertising for Mortgage Brokers

Search advertising can be a highly effective strategy to promote your mortgage services and connect with potential clients in need of home financing solutions. By utilizing search ads, you can reach individuals actively searching for mortgage information and services, making your business more visible and increasing leads. Below are five examples of how search advertising can benefit your mortgage brokerage and help you succeed in the market:

- Local Mortgage Brokerage Services: Create search ads targeting your local area to promote your mortgage brokerage services. When people in your vicinity search for terms like "mortgage broker near me" or "local home loan experts," your ad can appear at the top of search results, increasing your visibility to potential clients seeking mortgage advice in their community.

- First-Time Homebuyer Assistance: Advertise your services for first-time homebuyers through search ads. Use keywords like "first-time buyer mortgages" or "home loans for beginners" to reach individuals looking to purchase their first home. This strategy positions you as a knowledgeable mortgage broker specialized in helping first-time buyers navigate the homebuying process.

- Refinancing Solutions: Run search ads to promote your mortgage refinancing solutions. Target keywords like "mortgage refinancing rates" or "home loan refinance experts" to connect with homeowners seeking to refinance their existing mortgage. This strategy allows you to showcase your expertise in helping clients find better mortgage terms and save money.

- Jumbo and High-Value Mortgages: Showcase your jumbo and high-value mortgage services through search ads. Use keywords like "jumbo loan specialists" or "high-value home financing" to reach affluent homebuyers in need of substantial mortgage amounts. This strategy positions your brokerage as a reliable source for handling complex and sizable mortgage transactions.

- Online Mortgage Pre-Approval: Create search ads to promote your online mortgage pre-approval process. Use keywords like "instant mortgage pre-approval" or "fast home loan pre-qualification" to attract potential homebuyers looking to get pre-approved for a mortgage. This strategy allows you to highlight the convenience and efficiency of your pre-approval services.

7.) Content Marketing for Mortgage Brokers

As a mortgage broker, content marketing can be a powerful digital strategy to attract potential homebuyers and build credibility in the competitive mortgage industry. By providing valuable and informative content, you can establish yourself as a trusted expert and attract leads interested in your mortgage services. Here are five examples of how content marketing can help your mortgage broker business:

- Mortgage Guides and How-To Articles: Create comprehensive mortgage guides and how-to articles that educate potential homebuyers about the mortgage process. Cover topics such as understanding mortgage rates, different types of mortgages, and tips for improving credit scores. This content helps first-time homebuyers feel more informed and confident in approaching you for mortgage advice.

- Real Estate Market Updates: Publish regular content that provides insights into the real estate market and trends. Discuss factors affecting mortgage rates, housing demand, and local market conditions. By keeping potential clients informed about the market, you position yourself as a knowledgeable mortgage broker they can trust to navigate changing market conditions.

- Client Testimonials and Success Stories: Share content that features client testimonials and success stories. Let satisfied clients share their positive experiences working with you and how your mortgage solutions helped them achieve their homeownership dreams. These testimonials build trust and demonstrate your ability to deliver excellent service.

- Video Mortgage Q&A Sessions: Host video Q&A sessions where you answer common mortgage-related questions from your audience. Invite viewers to submit questions in advance or during the live session. This interactive content allows you to showcase your expertise and engage with potential clients directly.

- Homebuying Tips and Checklists: Offer homebuying tips and checklists to help potential clients through the homebuying journey. Provide content on how to prepare for a mortgage application, what documents are needed, and what to expect during the closing process. This practical content positions you as a helpful resource and assists clients at every step of their homebuying process.

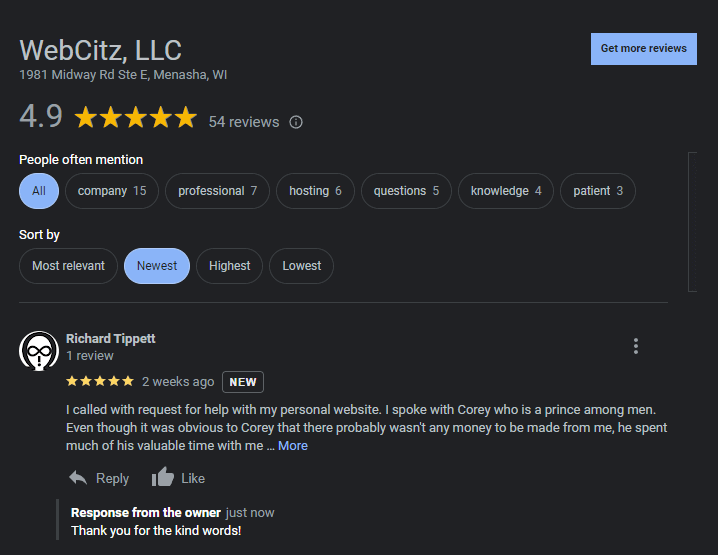

8.) Reputation Management for Mortgage Brokers

As a mortgage broker, reputation management is a crucial digital marketing strategy that can significantly impact your business success and attract more clients. It involves actively shaping and maintaining the online perception of your mortgage brokerage services. Here are five tailored examples of how reputation management can benefit your mortgage brokerage:

- Client Testimonials: Feature genuine testimonials from satisfied clients on your website and social media. Share stories of successful mortgage solutions, personalized service, and smooth transactions. These testimonials will enhance your reputation as a mortgage broker that provides excellent customer experiences and ensures client satisfaction.

- Showcase Mortgage Solutions: Highlight your expertise in various mortgage solutions, such as first-time homebuyer programs, refinancing options, or mortgage loan products, on your website and marketing materials. Showcase successful case studies and real-life examples. This emphasis on mortgage expertise will attract potential clients seeking a broker with a track record of finding tailored solutions for their financial needs.

- Informative Content on Mortgage Industry: Provide informative content on mortgage rates, industry trends, and financial advice on your website and social media. Offer valuable insights on navigating the mortgage market. This content marketing approach positions you as a trusted source of mortgage knowledge, attracting potential clients seeking reliable and knowledgeable mortgage professionals.

- Responsive Customer Service: Offer prompt responses to inquiries and client communication through phone calls, emails, or social media. Provide personalized attention to clients' mortgage needs and concerns. Demonstrating excellent customer service will foster positive word-of-mouth referrals and enhance your reputation as a mortgage broker that prioritizes client communication and satisfaction.

- Transparency and Trustworthiness: Emphasize your commitment to transparency, honesty, and ethical practices on your website and marketing materials. Clearly communicate your dedication to helping clients find the best mortgage solutions for their financial situation. This emphasis on trustworthiness will reinforce your reputation as a mortgage broker that prioritizes client trust and delivers reliable financial guidance.

9.) Video Marketing for Mortgage Brokers

As a mortgage broker, video marketing is your secret weapon to stand out in the competitive world of real estate financing. With video marketing, you can connect with potential clients, educate them about mortgage options, and build trust in your expertise. Here are five effective examples of how video marketing can help your mortgage brokerage:

- Loan Process Explanation: Create videos that walk potential clients through the mortgage loan process, from application to closing. Explain key terms, requirements, and documents needed, making the often complex process more understandable and approachable.

- Market Updates and Trends: Produce regular video updates on the current state of the real estate market, interest rates, and trends affecting mortgage rates. These videos position you as an informed expert and help clients make well-informed decisions.

- Client Testimonials: Film video testimonials from satisfied clients who have successfully obtained mortgages through your services. Testimonials build credibility and showcase your ability to deliver results, instilling confidence in potential clients.

- First-Time Homebuyer Tips: Create videos that offer valuable tips and advice to first-time homebuyers. Topics could include budgeting for a down payment, improving credit scores, and navigating the home buying process. These videos demonstrate your commitment to helping clients achieve their homeownership dreams.

- Comparing Mortgage Options: Develop comparative videos that outline different mortgage products available to clients, such as fixed-rate vs. adjustable-rate mortgages or conventional vs. FHA loans. These videos help clients make informed decisions about the best mortgage option for their needs.