Insurance Digital Marketing

Marketing Tips for Insurance Agents

We keep updated on the latest marketing trends for insurance agents. This includes search ads, social media, email marketing, lead generation, CRO, and more!

Digital Marketing Services

Digital Marketing Strategies for Insurance Companies

Digital marketing for insurance agents involves advertising through online channels like websites, search engines, social media, email, and mobile apps.

Many insurance agents think digital advertising is just another term for SEO or paid ads. While both of those services are used in insurance agency online marketing, neither completely explains the depth of a robust website marketing program.

Today's website advertising services often include dozens of strategies, all working in tandem to help your insurance company improve visibility and conversions.

Let's discuss what our digital advertisers have found to work best for those in this industry!

50+ Internet Marketing Solutions for Insurance Agents

Our team of online marketing professionals know the latest website marketing trends for insurance agents.

For years, our team has assisted insurance agents with their digital marketing goals. The strategies / tactics discussed in this section can help with website advertising for insurance agents and even:

- Life Insurance Companies

- Health Insurance Companies

- Auto Insurance Companies

- Homeowners Insurance Companies

- Renters Insurance Companies

- Disability Insurance Companies

- Pet Insurance Companies

- Liability Insurance Companies

- Commercial Insurance Companies

- Travel Insurance Companies

- Flood Insurance Companies

- Cyber Insurance Companies

- ...and more!

A Few of Our Digital Marketing Experts

1.) Lead Generation for Insurance Companies

Lead generation is a digital marketing strategy that can greatly benefit insurance companies. It focuses on attracting potential customers and capturing their contact information to generate leads for insurance products or services. By implementing targeted lead generation tactics, you can effectively grow your customer base and increase sales opportunities. Here are 5-10 specific strategies tailored to insurance companies:

- Optimized Insurance Website: Create a user-friendly website that provides valuable information about insurance policies, coverage options, and claims procedures. Include a prominent contact form or quotation request form to capture potential leads' contact information. By offering a seamless online experience, you can generate leads who are interested in obtaining insurance coverage.

- Targeted Facebook Ads for Specific Life Events: Utilize Facebook's advanced targeting features to run advertising campaigns aimed at individuals who are going through specific life events such as marriage, having a baby, or buying a new home. Highlight the importance of insurance coverage during these events. By reaching out to individuals who are experiencing significant life changes, you can generate leads who are more likely to consider insurance products.

- Collaboration with Real Estate Agents: Establish partnerships with local real estate agents and offer them referral incentives for recommending your insurance products to their clients. Provide them with marketing materials and training on insurance coverage related to homeownership. By collaborating with real estate agents, you can generate leads from individuals who require insurance coverage for their new homes.

- Targeted Google Ads for Specific Insurance Keywords: Utilize Google Ads to run advertising campaigns targeted at individuals searching for specific insurance keywords such as "auto insurance," "home insurance," or "life insurance." Highlight the benefits and competitive rates of your insurance products. By appearing in search results, you can generate leads who are actively seeking insurance coverage.

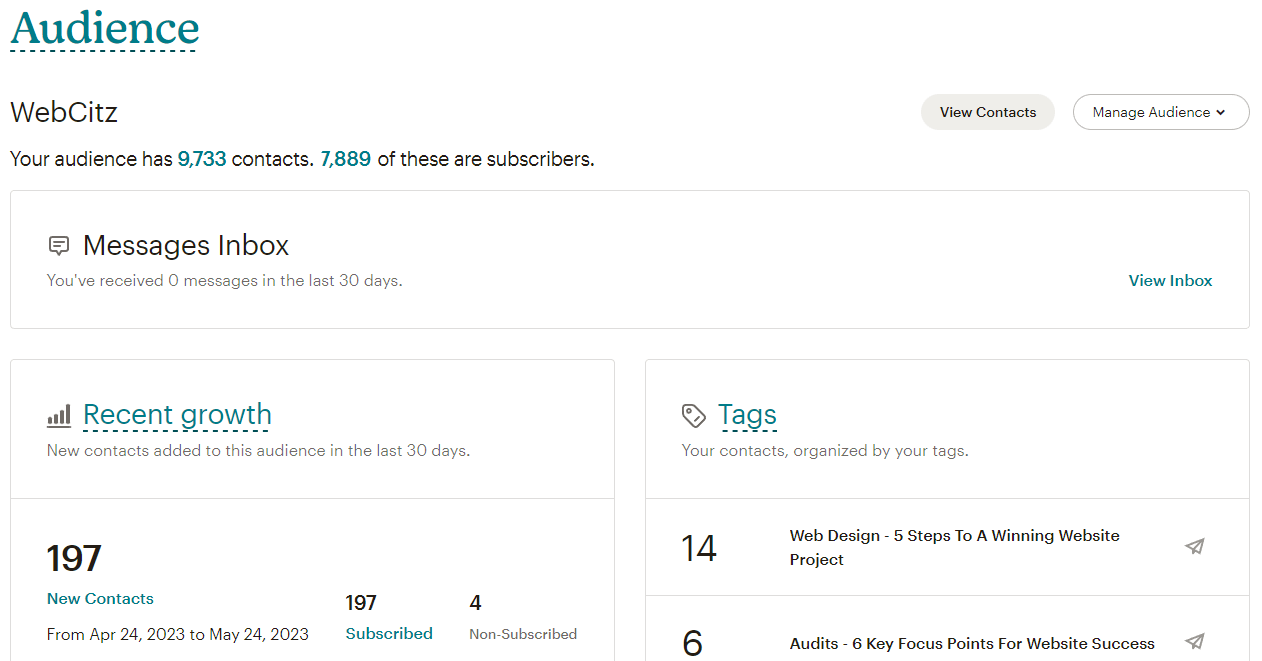

- Email Marketing with Personalized Recommendations: Develop targeted email campaigns aimed at individuals who have subscribed to your newsletter or shown interest in your insurance products. Provide personalized recommendations based on their specific needs and circumstances. By offering tailored solutions, you can generate leads who are more likely to engage with your insurance offerings.

- Collaboration with Employee Benefits Programs: Partner with companies or organizations that offer employee benefits programs. Provide them with insurance coverage options for their employees and offer exclusive discounts or group rates. By collaborating with employee benefits programs, you can generate leads from individuals who are seeking comprehensive insurance coverage through their employers.

- Targeted LinkedIn Ads for Professionals: Utilize LinkedIn's advertising platform to run campaigns targeted at professionals in specific industries or job roles. Highlight the importance of insurance coverage for career progression and financial security. By reaching out to professionals who value insurance protection, you can generate leads who are more likely to consider your insurance products.

- Online Reviews and Testimonials: Encourage satisfied customers to leave reviews and testimonials on popular review websites or your website. Showcase these reviews to build trust and credibility. By showcasing the positive experiences of previous customers, you can generate leads who are influenced by their feedback and are more likely to choose your insurance products.

- Targeted Content Marketing for Specific Demographics: Create informative blog posts or videos that address insurance topics relevant to specific demographics such as young families, retirees, or small business owners. Offer valuable insights and advice to establish your expertise. By providing valuable content, you can generate leads from individuals who are seeking reliable insurance information and solutions.

- Collaboration with Financial Advisors: Establish partnerships with financial advisors or wealth management firms. Offer them training on insurance products and collaborate on joint seminars or webinars to educate clients about the importance of insurance coverage in their financial plans. By networking with financial advisors, you can generate leads from individuals who trust their guidance and seek comprehensive financial protection.

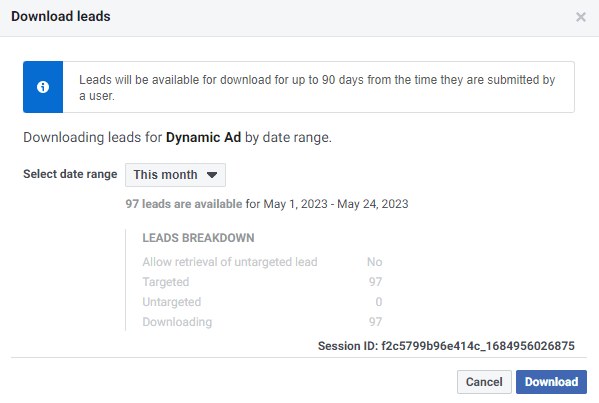

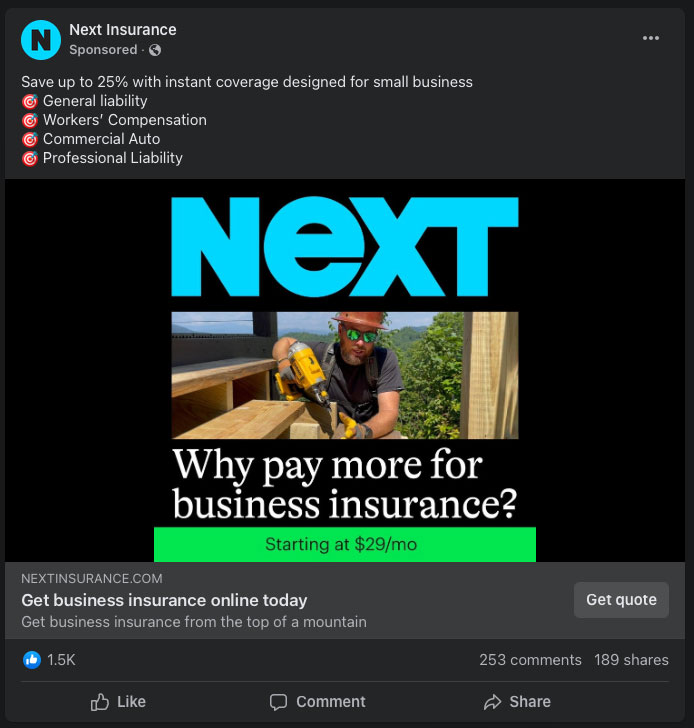

2.) Social Advertising for Insurance Companies

Social advertising is a powerful digital marketing strategy for insurance companies to connect with potential customers, showcase your insurance offerings, and build trust in your services. By utilizing social media platforms, you can reach your target audience, generate leads, and increase brand recognition within the insurance industry. Here are five specific examples of how social advertising can benefit your insurance business:

- Targeting Specific Demographics: Craft social media ads to target specific demographics that are most likely to be interested in your insurance products. For example, you can target young adults for health insurance or families for home and auto insurance. By tailoring your ads to specific demographics, you can improve the relevance of your messaging and increase the chances of attracting potential customers.

- Promoting Seasonal Insurance Coverage: Use social advertising to promote seasonal insurance coverage, such as travel insurance during the holiday season or flood insurance during the rainy season. Target individuals who may be planning trips or residing in flood-prone areas. By highlighting the importance of seasonal coverage, you can encourage potential customers to safeguard their assets and well-being.

- Retargeting Abandoned Quote Requests: Create social media ads to retarget users who have previously requested insurance quotes but didn't complete the process. Show them personalized ads with incentives, such as special discounts or additional coverage options. By retargeting these potential customers, you can remind them of their interest in your services and encourage them to finalize their insurance purchase.

- Showcasing Customer Testimonials: Utilize social advertising to showcase customer testimonials and success stories. Target individuals who may be researching insurance providers or looking for feedback from satisfied customers. By featuring real-life experiences, you can build trust and credibility for your insurance company, which can be crucial in the decision-making process for potential clients.

- Promoting Educational Content: Create social media ads to promote educational content related to insurance topics, such as blog posts, infographics, or videos explaining different coverage options or insurance jargon. Target individuals seeking information about insurance or insurance-related topics. By offering valuable educational content, you can position your insurance company as a reliable and knowledgeable resource, fostering a positive image and attracting potential customers.

3.) Conversion Rate Optimization (CRO) for Insurance Agencies

Conversion rate optimization is a crucial digital marketing strategy for insurance agencies to increase lead generation and customer acquisition. By implementing targeted optimization techniques, you can enhance the effectiveness of your website and paid advertising efforts, ultimately converting more prospects into valuable customers. Here are some specific CRO strategies tailored for insurance agencies:

- Clear and Simple Quote Forms: Optimize your quote request forms to make them easy to understand and fill out. Minimize the number of fields required, and clearly communicate the benefits of requesting a quote. Simplifying the process can lead to more submissions and potential leads.

- Highlight Testimonials and Reviews: Showcase positive testimonials and reviews from satisfied clients on your website. Social proof plays a significant role in the insurance industry, and potential customers are more likely to trust your agency when they see positive feedback from others.

- Offer Free Consultations: Provide the option for visitors to schedule free consultations with your insurance agents. This personalized interaction can help potential customers better understand their insurance needs and build a relationship of trust, increasing the chances of conversion.

- Use Live Chat Support: Implement live chat support on your website to assist visitors in real-time. Quick and helpful responses to inquiries can overcome hesitations and provide immediate solutions, improving the likelihood of converting prospects into leads.

- Utilize Videos: Incorporate video content on your website and in advertising campaigns. Videos can explain complex insurance concepts, showcase the benefits of different insurance plans, and present customer success stories. Engaging videos can increase customer engagement and conversions.

- Offer Exclusive Promotions: Create exclusive promotions, discounts, or special offers for specific insurance plans. Limited-time offers or unique benefits can create a sense of urgency and encourage prospects to take action and inquire about the promotion.

- Mobile Optimization: Ensure your website and landing pages are optimized for mobile users. Many potential customers search for insurance solutions on their smartphones. A mobile-friendly experience improves user satisfaction and encourages conversions.

- Use Clear and Compelling Call-to-Actions (CTAs): Design CTAs that clearly communicate the desired action and the value of taking that action. Use actionable language and contrasting colors to make the CTA stand out, increasing the chances of visitors clicking on them.

- Segmentation and Personalization: Implement segmentation and personalization techniques in email marketing campaigns. Tailor your communications to specific target audiences based on their interests and needs, increasing the relevance and effectiveness of your messages.

- Implement A/B Testing: Conduct A/B tests on different elements of your website and ads, such as headlines, images, or CTA buttons. Analyzing the results of these tests allows you to identify the most effective elements and optimize your marketing efforts accordingly.

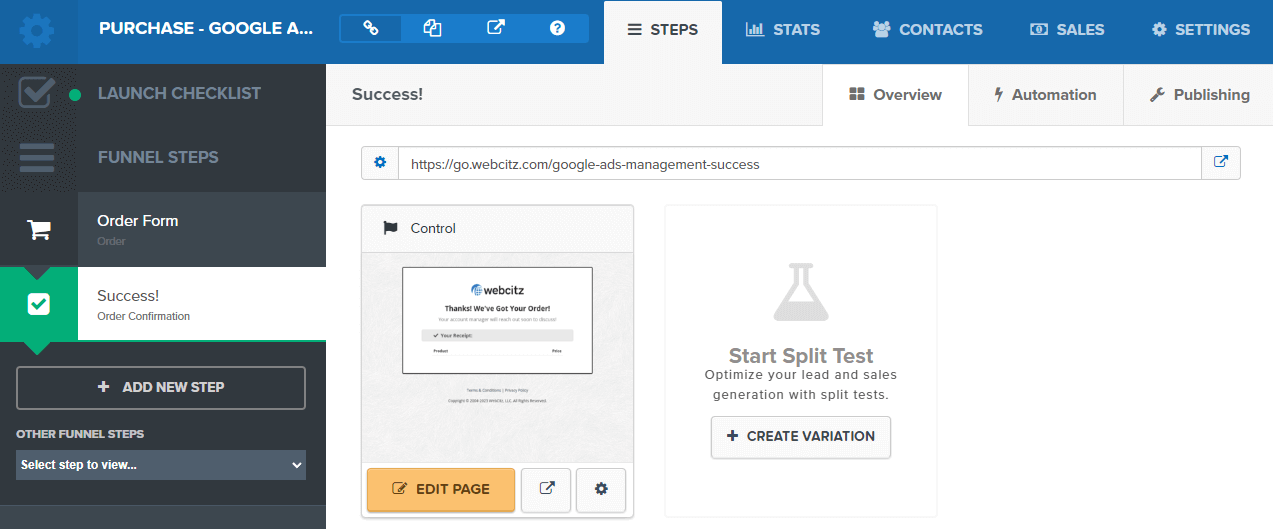

4.) Sales Funnels for Insurance Agents

As an insurance agent, sales funnels can be an effective digital marketing strategy to attract potential clients, build trust, and convert leads into policyholders. Sales funnels guide prospects through a step-by-step process, addressing their specific insurance needs and concerns, ultimately leading to increased policy sales and business growth. Here are 5 examples of how sales funnels can benefit your insurance agency:

- Lead Magnet Funnel: Create a landing page offering a valuable lead magnet, such as an e-book on "Understanding Insurance Policies" or a "Checklist for Choosing the Right Insurance Coverage." Use targeted online advertising or social media to drive traffic to the landing page. The landing page should capture leads' contact information in exchange for accessing the lead magnet. Follow up with email sequences that provide additional insurance tips, showcase your expertise, and offer personalized insurance quotes to convert leads into policyholders.

- Life Event Funnel: Design a landing page targeting individuals who have recently experienced life events, such as getting married, having a baby, or buying a new home. Utilize data from social media platforms or partner with local real estate agents to identify potential clients. The landing page should address the specific insurance needs related to the life event and offer a free consultation. Follow up with email sequences that provide tailored insurance recommendations based on the life event, highlight the importance of adequate coverage, and offer special discounts or bundles to encourage policy purchase.

- Retirement Planning Funnel: Create a landing page focusing on retirement planning and insurance options for seniors. Use content marketing or partnerships with retirement planning websites to attract potential clients. The landing page should emphasize the importance of securing retirement income and offer a retirement planning guide or webinar. Follow up with email sequences that educate prospects on various insurance products suitable for retirement, showcase annuity or long-term care insurance options, and offer personalized retirement planning consultations to close sales.

- Referral Funnel: Design a landing page targeting current policyholders to refer their friends and family to your insurance agency. Utilize email marketing or create a referral program. The landing page should highlight the benefits of referring new clients, such as discounts or rewards. Follow up with email sequences that remind policyholders to refer others, provide referral resources or templates, and express gratitude for successful referrals through special incentives or gifts.

- Policy Review Funnel: Create a landing page offering a complimentary policy review service for existing policyholders. Use email marketing or direct mail to notify them of the review opportunity. The landing page should emphasize the importance of regular policy reviews to ensure adequate coverage and identify potential savings. Follow up with email sequences that prompt policyholders to schedule their policy review, provide personalized policy recommendations, and offer upsells or cross-sell opportunities based on their unique insurance needs.

5.) Email Marketing for Insurance Agencies

Email marketing is a powerful digital marketing strategy for insurance agencies like yours, helping you engage with prospects and clients, promote insurance products, and build lasting relationships. With targeted and personalized email campaigns, you can effectively communicate your offerings and address the unique needs of your audience. Here are six examples of how email marketing can benefit your insurance agency:

- Welcome and Onboarding: Send a warm welcome email to new leads or clients who have just signed up for insurance services. Use this opportunity to introduce your agency, provide key contact information, and guide them through the onboarding process. A personalized welcome email can make a positive first impression and set the tone for future interactions.

- Policy Renewal Reminders: Set up automated email reminders to notify clients about upcoming policy renewals. Include a call-to-action for them to review their coverage and make any necessary updates. This proactive approach shows that you care about their needs and can help improve customer retention rates.

- Seasonal Insurance Tips: Send out informative email newsletters that offer seasonal insurance tips and advice. For example, you can provide safety tips for winter driving or home protection during stormy seasons. Positioning your agency as a source of valuable information can increase client loyalty and brand trust.

- Referral Programs: Encourage satisfied clients to refer their friends and family to your insurance agency. Implement a referral program that rewards both the referrer and the new client. Use email marketing to promote the referral program, highlight the benefits, and track successful referrals. Word-of-mouth recommendations are highly valuable in the insurance industry.

- Life Events and Coverage Needs: Send personalized emails based on life events, such as marriage, childbirth, or home purchase. Tailor the content to address their changing insurance needs. For instance, congratulate newlyweds and offer information about bundling policies for potential discounts. This level of personalization shows that you understand and care about their individual circumstances.

- Claim Assistance and Support: Provide guidance and support through email communications when clients need to file insurance claims. Offer step-by-step instructions on how to initiate the claims process and share resources that can help them throughout the process. Timely and helpful communication can alleviate stress during difficult times, reinforcing your agency's commitment to excellent customer service.

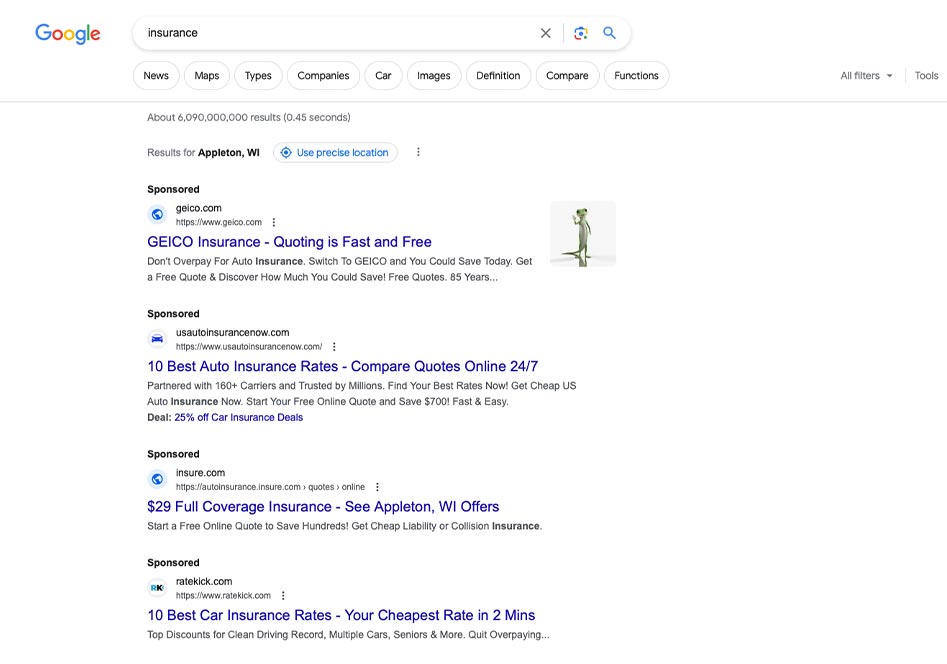

6.) Search Advertising for Insurance Companies

Search advertising can be a highly effective strategy to promote your insurance products and services and connect with potential customers in need of insurance coverage. By utilizing search ads, you can reach individuals actively searching for insurance solutions, making your business more visible and increasing leads. Below are five examples of how search advertising can benefit your insurance company and help you succeed in the competitive market:

- Local Insurance Services: Create search ads targeting your local area to promote your insurance services. When people in your target location search for terms like "insurance companies near me" or "local insurance agents," your ad can appear at the top of search results, increasing your visibility to potential customers seeking insurance coverage in their vicinity.

- Auto Insurance Quotes: Advertise your auto insurance quotes through search ads. Use keywords related to car insurance, such as "affordable auto insurance" or "cheap car insurance quotes," to reach drivers looking for cost-effective insurance options. This strategy positions your insurance company as a reliable provider of competitive auto insurance rates.

- Life Insurance Planning: Run search ads to promote your life insurance planning services. Target keywords like "life insurance policy advisors" or "financial planning for the future" to reach individuals seeking comprehensive life insurance solutions. This strategy showcases your expertise in helping customers secure their family's financial future.

- Business Insurance Coverage: Showcase your business insurance coverage through search ads. Use keywords like "commercial insurance for small businesses" or "liability insurance for companies" to attract business owners in need of comprehensive insurance protection. This strategy highlights your ability to safeguard businesses from potential risks and liabilities.

- Health Insurance Enrollment: Create search ads to promote your health insurance enrollment services. Use keywords like "health insurance plans for individuals" or "family health coverage options" to connect with individuals and families seeking health insurance. This strategy positions your insurance company as a reliable resource for finding the right health insurance plans.

7.) Content Marketing for Insurance Agents

Content marketing is a powerful digital strategy that can significantly benefit your insurance agency. By creating valuable and informative content, you can attract potential clients, showcase your expertise in insurance solutions, and establish trust with individuals seeking reliable coverage and protection for their assets and well-being.

- Insurance Explainers: Develop content that explains different types of insurance coverage in simple terms. Offer articles or videos that break down complex insurance jargon and concepts, such as liability, deductibles, and premiums. This content helps potential clients understand the importance of insurance and how various policies can safeguard their financial future.

- Client Testimonials: Share authentic client testimonials and reviews from satisfied policyholders. Include details on how your insurance agency has provided exceptional service, handled claims efficiently, and offered reliable coverage. This content builds trust and credibility, demonstrating to potential clients that your insurance agency is dedicated to delivering excellent customer experiences.

- Home and Auto Safety Tips: Create content that offers home and auto safety tips, such as measures to prevent accidents, protect against theft, and reduce property risks. Provide seasonal safety guides, like preparing for hurricanes or winterizing vehicles. This content positions your insurance agency as a reliable source of practical advice, attracting potential clients looking for comprehensive insurance solutions that prioritize safety.

- Life Event Coverage Guides: Develop content that addresses insurance needs during significant life events, such as getting married, having children, or retiring. Offer insights into how life changes can impact insurance requirements and the importance of updating coverage accordingly. This content appeals to individuals experiencing life transitions and encourages them to seek advice from your insurance agency for personalized coverage solutions.

- Industry Updates and News: Share content that provides updates on the insurance industry, changes in regulations, and emerging trends. Offer insights into how these developments may affect insurance policies and premiums. This content positions your insurance agency as a knowledgeable expert, attracting potential clients seeking informed and up-to-date insurance advice.

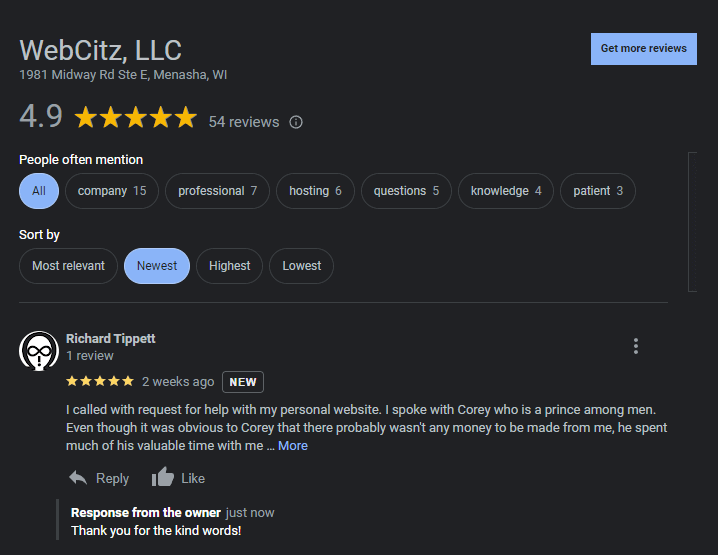

8.) Reputation Management for Insurance Companies

As an insurance company, reputation management is a crucial digital marketing strategy that can significantly impact your business success and attract more clients. It involves actively shaping and maintaining the online perception of your insurance services. Here are five tailored examples of how reputation management can benefit your insurance organization:

- Customer Testimonials: Feature genuine testimonials from satisfied clients on your website and marketing materials. Share stories of how your insurance policies have provided financial security and peace of mind during challenging times. These testimonials will enhance your reputation as an insurance company that prioritizes customer satisfaction and delivers reliable coverage.

- Online Reviews and Ratings: Monitor and respond to customer reviews on platforms like Google, Yelp, or insurance-specific review websites. Address both positive and negative feedback with empathy and professionalism. Managing online reviews will demonstrate your commitment to customer feedback and build trust with potential clients.

- Informative Insurance Guides: Create and share informative content on insurance types, coverage options, and claims processes on your website and social media. Offer helpful advice on selecting the right insurance policies for different needs. This content marketing approach positions you as an expert in insurance matters, attracting potential clients seeking reliable insurance advice.

- Community Involvement: Highlight your involvement in community initiatives, sponsorships, or charitable events on your website and social media. Showcase your commitment to giving back to the community. This emphasis on community engagement will reinforce your reputation as an insurance company that cares about more than just financial transactions.

- Responsive Customer Service: Prioritize quick and courteous communication with customers, whether it's through phone calls, emails, or social media. Address inquiries and claims promptly and professionally. Demonstrating excellent customer service will foster positive word-of-mouth referrals and enhance your reputation as an insurance company that values client satisfaction and provides reliable support.

9.) Video Marketing for Insurance Companies

As an insurance company, you can connect with your audience, simplify complex concepts, and build trust with potential clients. Video marketing offers you a dynamic platform to explain insurance products, address customer concerns, and showcase your expertise in a visually engaging way. Here are five effective examples of how video marketing can benefit your insurance business:

- Insurance Explainers: Create concise and easy-to-understand videos that explain various insurance products you offer. Break down complex coverage options, terms, and conditions into simple visuals. Insurance explainer videos help potential clients grasp the benefits and value of your policies, leading to more informed purchasing decisions.

- Customer Testimonials: Film video testimonials from satisfied clients who have experienced positive outcomes from their insurance coverage with your company. Let them share their personal stories of how your insurance solutions protected their assets and provided peace of mind. Customer testimonial videos build trust and credibility, encouraging potential clients to choose your insurance services.

- Claims Process Overview: Create videos that walk potential clients through the insurance claims process. Explain the steps they need to follow, the documentation required, and the support they can expect from your team. Claims process overview videos demonstrate your commitment to customer support and service, reassuring potential clients that you'll be there for them when they need it the most.

- Risk Management Tips: Produce informative videos that offer risk management tips for businesses and individuals. Share valuable advice on how to minimize risks, prevent accidents, and protect their assets. Risk management tip videos position your insurance company as a knowledgeable partner in helping clients safeguard their interests.

- Community Engagement: Share videos showcasing your company's involvement in community events, sponsorships, and charitable initiatives. Highlight how your insurance company gives back and supports local causes. Community engagement videos foster a positive brand image and show potential clients that your insurance company cares about the community it serves.